Twitter is an example of a centralized app, with users relying on it as an intermediary to send and receive messages. As such, users play by the rules, it enforces and the algorithm it uses to control content. In the early days of Bitcoin, validators were largely amateur hobbyists. Still, as the math problems in the Bitcoin proof-of-work system have become more challenging, the amount of processing power needed to solve each one has increased exponentially.

Distributed apps help users send and receive data directly without an intermediary. It claims that as an app, it doesn’t optimize for advertising revenues, an issue it says users of centralized apps suffer from. A smart contract is a digital agreement between two or more parties that will execute itself once certain conditions are met. For example, Account A will release Asset X once it has received Asset Y from Account B. This could make property sales or the transfer of ownership faster and less liable to fraud. Proof of stake requires validators to stake their crypto holdings to earn the chance to validate transactions and add blocks to the blockchain.

Shapella’s stable rollout likely drove positive sentiment to Ethereum staking-based protocols. With PoS and sharding both enabled, Ethereum developers expect that they will make further tweaks to enhance the security of the network. That includes adding anonymity features to conceal validator identities behind block proposals. It also includes leveraging new technologies such as the Verifiable Delay Function to further secure the randomness of validator assignments and make it harder for malicious actors to disrupt the network. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Smart contracts provide a decentralized protocol to facilitate and verify negotiations that cannot be tampered with or manipulated. The former is the first cryptocurrency, designed as a store of value and medium of exchange—but today mostly employed as a speculative risk asset. The latter was designed as a decentralized computing network, which has given rise to the decentralized finance space. Conversion rates are based on CoinDesk’s Bitcoin Price Index and the price indices of other digital assets.

Ethereum price history

However, a close study of the coin’s overall price trend certainly proves the long-range potential of the second largest cryptocurrency. After being awarded a $100,000 grant from venture capitalist Peter Thiel, he devoted his remaining time and energy to creating Ethereum. The official Ethereum blockchain network went live in 2015 along with its native token Ether which followed an $18 million crowd sale. In addition, most NFT markets require ETH to conduct trades on the platform. Although other blockchains now provide NFT functionality, it was Ethereum that started it.

However, key differences can be observed when it comes to their consensus algorithms. Both Ethereum and Bitcoin have their own distinct consensus algorithms which means that the ways they verify the validity of the information being added to the ledger are different. The idea of Ethereum’s platform was conceived by Vitalik Buterin – a programmer from Toronto, Canada. However, the project in its current shape and form has been co-founded by Vitalik Buterin, Mihai Alisie, Anthony Di Lorio, and Charles Hoskinson. Buterin also announced that Dr. Gavin Wood and Joseph Lubin are also involved.

Statistics

World currency prices are based on rates obtained via Open Exchange Rates. It took about three years for the second-largest cryptocurrency by market cap to retest its previous all-time high price. Between February and May 2021, eth’s price more than tripled to set a new all-time high of $4,379. However, it wasn’t until 2021 when the NFT market exploded, that Ethereum was to receive mass adoption. The NFT market gained immense traction in 2021 as tokenized digital items were made available using Ethereum.

$14 Trillion Earthquake: Fidelity And BlackRock Are Quietly Laying The Groundwork For The Next Bitcoin, Ethereum And Crypto Price Bull Run – Forbes

$14 Trillion Earthquake: Fidelity And BlackRock Are Quietly Laying The Groundwork For The Next Bitcoin, Ethereum And Crypto Price Bull Run.

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

Get the latest crypto news, updates, and reports by subscribing to our free newsletter. You will receive an email with instructions on how to reset your password in a few minutes. When the price hits the target price, an alert will be sent to you via notification. The bulls have to take the initiative, either we get a buy reaction now or continue the short-term decline.

More about Ethereum

For example, if an entire industry or sector drops because of unexpected headlines, the short position in Ethereum will offset losses from the drop in Ethereum’s long position. Block rewards are new ether coins that are created when each new block is discovered and are given to the successful miner for their efforts. Once a block is added, the rest of the mining network verifies it to make sure the balances are correct and the transaction isn’t a “double-spend,” i.e., someone isn’t trying to spend money they don’t have. Smart contracts are code-based programs that are stored on the Ethereum blockchain and automatically carry out certain functions when predetermined conditions are met. That can be anything from sending a transaction when a certain event takes place or loaning funds once collateral is deposited into a designated wallet. The smart contracts form the basis of all dapps built on Ethereum, as well as all other dapps created across other blockchain platforms.

- It wasn’t until the 2017 bull crypto market started to pick up in May of that year that ETH price went above $100 for the first time.

- Polygon, an open-course blockchain that was launched in 2017, was built to address the scalability issues within Ethereum.

- Once a block is added, the rest of the mining network verifies it to make sure the balances are correct and the transaction isn’t a “double-spend,” i.e., someone isn’t trying to spend money they don’t have.

- Bitcoin, founded in 2009 by Satoshi Nakamoto, was the first successful blockchain network to launch.

- From there, ether skyrocketed to a peak of $414 in June 2017 before correcting.

A crypto trading pair consists of two assets being exchanged directly against each other on a trading platform. Liquidity providers can generate yield by providing funding to traders wanting to trade with leverage. The Merge involved much complexity and was achieved with the efforts of the blockchain’s core developers. To accomplish it, the Ethereum mainnet – the original execution layer – merged with the Beacon Chain, a separate proof-of-stake consensus layer. Ethereum made its debut in the market with a token launch price of $0.31 and reached an astounding all-time high above $4,880 in November 2021.

UNUS SED LEO provides utility for those seeking to maximize the output and capabilities of the Bitfinex trading platform. The update reduced the energy consumption of the Ethereum blockchain by 99.95%. The Merge switched the consensus protocol of the Ethereum blockchain from proof-of-work to proof-of-stake . As the need for blockchain grows, Ethereum remains a top choice for developers to leverage their DeFi technologies, relying on the blockchain’s multi-functional and multi-layered ease of access. Meanwhile, going back to the ETH/USD chart, crypto analyst Alisays Ethereum appears to be breaking out.

ETHEREUMPRICE.ORG

ETH, on the other hand, has been entirely devastated, as the cryptocurrency is currently sitting at around $120, which is over 90 percent less since its peak. ETH has also lost its position as the second largest cryptocurrency to Ripple . The idea behind Bitcoin and Ethereum pairs trading is to make the combined position market-neutral, meaning the overall market’s direction will not affect its win or loss . After the merge, there will be additional, smaller upgrades needed. The next task for Ethereum developers will be enabling sharding, which creates multiple mini-blockchains. Each shard will be responsible for verifying its own set of transactions rather than the entire network verifying every single transaction.

Tomiwabold is a cryptocurrency analyst and an experienced technical analyst. He pays close attention to cryptocurrency research, conducting comprehensive price analysis and exchanging predictions of estimated market trends. Deutscher notes that the sustained strength of Ethereum against Bitcoin would bode well for the altcoins’ performance. Oftentimes, the altcoin market tends to benefit from Ethereum’s show of strength against Bitcoin, with this often an indicator of altcoins’ performance. The fact that the last time Ethereum traded at such oversold levels to Bitcoin, it produced fresh highs on the ETH/BTC chart raises the possibility of a sustained rebound in the coming weeks.

Price analysis 3/24: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC – Cointelegraph

Price analysis 3/24: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC.

Posted: Fri, 24 Mar 2023 07:00:00 GMT [source]

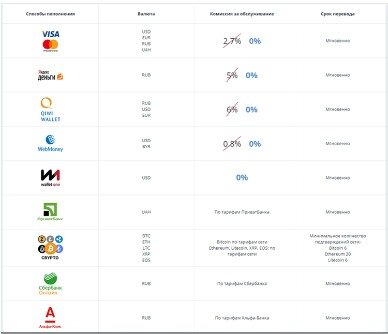

Deposit forex-world.net/ to our exchange and trade with deep liquidity and low fees. Has a trading restriction applied, any market orders or triggered pending entry orders will be rejected and deleted. Pop ups will appear on your screen informing of the reason for the rejection. Please note, however, that hours are subject to change based on Daylight Savings Time. Is a crypto-cross pair which represents the value of Ether relative to Bitcoin.

Built for replicability and reliability, in continuous operation since 2014, the XBX is relied upon by asset allocators, asset managers, market participants and exchanges. The XBX is the flagship in a portfolio of single- and multi-asset indices offered by CoinDesk. First proposed in 2013 by Russian-Canadian computer programmer Vitalik Buterin, Ethereum was designed to expand the utility of cryptocurrencies by allowing developers to create their own special applications. Unlike traditional apps, these Ethereum-based applications, called “decentralized applications,” or dapps, are self-executing thanks to the use of smart contracts. Ethereum is known as the most popular cryptocurrency after Bitcoin.

Polygon, an open-course blockchain that was launched in 2017, was built to address the scalability issues within Ethereum. This layer 2 scaling solution leverages the power of Ethereum while offering its users cheaper rates, more scalability, and faster speeds than the Ethereum mainnet. Broken Wing ButterflyA broken wing butterfly – or a skip strike butterfly, is a net credit, high probability trade that can make money even if your speculation is directionally wrong. Currently, ETH/BTC is caught in a so-called ascending triangle pattern.

At the outset, the original cryptocurrency’s designers wanted to help people to send and receive payments without an intermediary, such as a bank. They are the biggest names in crypto, and their combined market capitalization equals more than 60% of the $1 trillion crypto market. Solana is a fast-growing layer 1 blockchain platform that supports smart contracts.

Therefore, it will take some time for Solana to overtake Ethereum. In DeFi, crypto participants can lend/borrow, stake, and even become liquidity providers in DEXs . The vast majority of all DeFi protocols operate within the Ethereum ecosystem. It is a cryptocurrency which places the emphasis on security, privacy, and the fact that it is supposedly untraceable. Bitcoin Cash is the result of a hard fork which took place on August 1st, 2017.

Bitcoin’s average block time currently is a little bit more than eight minutes, while Ethereum’s block time is around 25 seconds, according to BitInfoCharts. Ethereum was launched back in 2015 and it’s by far the largest open-ended decentralized software platform which enables the creation of Distributed Applications and Smart Contracts. Let’s have a look at the most important differences between Bitcoin and Ethereum – their technology, mining, charts, and, of course, some alternatives.

TastyEth price vs btc and Marketing Agent are separate entities with their own products and services. This proof-of-stake crypto is like Ethereum in that it is able to store smart contracts in its chain. It has incredibly high transaction throughput while keeping fees at rock-bottom prices. This blockchain tends to place more emphasis on being developer friendly than the blockchain itself, which is what most networks focus on.

This marked a 140x increase, which was far more than Bitcoin’s price improvement. /CNW/ — Ondo Finance today announced a novel token, OMMF, that allows global stablecoin holders to invest in tokenized exposure to US money market funds. Meme coins are badly lagging the broader crypto market, and that’s a problem. Can any of the company-specific risk be diversified away by investing in both Bitcoin and Ethereum at the same time? Joseph Lubin, Jeffrey Wilcke and Wood were introduced later as the project’s last three co-founders.

Bitcoin and Ethereum Price Predictions: BTC and ETH Recover Over … – Cryptonews

Bitcoin and Ethereum Price Predictions: BTC and ETH Recover Over ….

Posted: Wed, 29 Mar 2023 07:00:00 GMT [source]

This is a bullish pattern, meaning that in most cases the price will shoot up. This could happen as soon as today or could take a few more weeks. However, 2018 has been a lot less favorable for cryptocurrency investors and it has taken the BTC vs ETH comparison to an entirely different vertical. If 2017 was all about which currency gained more, 2018 is more about which one lost more. It’s interesting to note that Ethereum has fairly faster block time – the amount of time necessary to validate a block.

- The ratio in the chart above divides the price of Ether by the price of Bitcoin and represents the amount of Bitcoin it takes to buy 1 Ether.

- As we explained before, Ethereum is a platform rather than a digital currency and, as such, we’d be looking at other platforms which are designated to enable the creation of decentralized apps.

- For example, Account A will release Asset X once it has received Asset Y from Account B. This could make property sales or the transfer of ownership faster and less liable to fraud.

- That includes adding anonymity features to conceal validator identities behind block proposals.

The price of %Ethereum ($ETH) has risen 12% and broken above $2,100 U.S. following the successful completion of the %Shapella network upgrade. To check Ethereum’s price live in the fiat currency of your choice, you can use Crypto.com‘s converter feature in the top-right corner of this page. If you are new to crypto, use the Crypto.com University and our Help Center to learn how to start buying Bitcoin, Ethereum, and other cryptocurrencies.

Block rewards have been reduced two times since the first ever Ethereum block was mined. The reductions in block rewards aren’t programmed into Ethereum’s code like Bitcoin’s halving events are. Instead, members of the community propose changes, called “Ethereum Improvement Proposals,” or EIPs, and the rest of the community votes on whether to include the proposals in updates to Ethereum’s software code. In addition to tracking price, volume and market capitalisation, CoinGecko tracks community growth, open-source code development, major events and on-chain metrics.